Business owners re-think exit plans as tax changes and market turbulence loom

New research from professional services group S&W, which polled 500 UK business owners, has revealed that more than four in ten (44%) of those working towards an exit have postponed their plans over the last year. Significantly, almost as many have brought their exit forward (41%). Only 15% say their timescales remain unchanged.

Business owners re-think exit plans as tax changes and market turbulence loom

New research from professional services group S&W, which polled 500 UK business owners, has revealed that more than four in ten (44%) of those working towards an exit have postponed their plans over the last year. Significantly, almost as many have brought their exit forward (41%). Only 15% say their timescales remain unchanged.

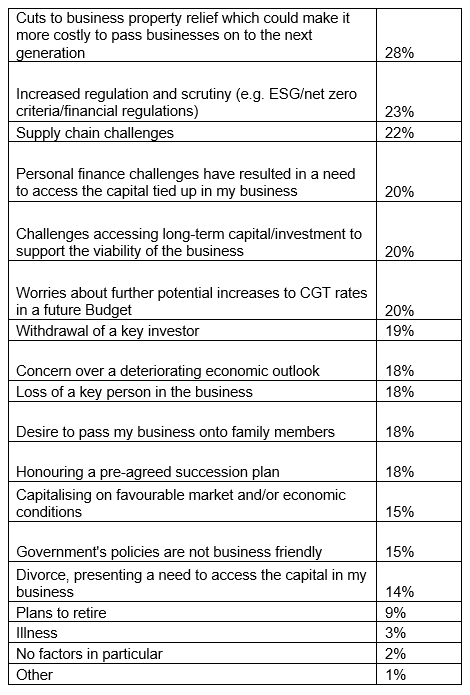

The research, published as part of S&W’s The BOSS (Business Owners Sentiment Survey) report, reveals that a sizeable number who have fast-tracked exits have done so over worries about tax changes. S&W’s poll found 28% of those who had accelerated their exits, did so because of cuts to business property relief due to take effect from April 2026. This could make it more costly to pass businesses on to the next generation. Meanwhile, 20% of those surveyed who accelerated exits were worried about a potential increase to CGT rates in a future Budget. See table below for a full list of the different factors.

Mark Brockway, corporate finance Partner at S&W commented: “The split between those who have brought forward their exit strategy and those who postponed it may not be as odd as it first appears. Much will depend on owners’ timescales and their optimism or otherwise about the future. For some, the economic uncertainty resulting from both domestic and international issues – and its impact on valuations – is an obvious motivation to delay.

“However, for other owners, perhaps having already delayed an exit to give time to recover from the pandemic, a further wait does not appeal. With significant challenges facing the UK and global economy, and no easy answers, some may reasonably conclude that a delay won’t necessarily bring an improvement.

“Many businesses thinking of selling are attractive to buyers, with many sectors seeing consolidation. Those owners thinking it’s now or never for a sale can take advantage.”

Laura Hayward, tax Partner at S&W commented: “Our research shows that many business owners working towards an exit have fast-tracked plans because of unfavourable tax changes already announced or others they fear might come in the future. Many businesses have had a tough time in recent years, and it is completely understandable some owners are hoping to realise the gains of their successes sooner rather than later.

“Business property relief plays a huge role in helping family businesses pass from generation to generation. Businesses urgently need to review their plans before next April.

“Furthermore, we know from talking to business owners that many have considerable worries that taxes could be increased further in the Autumn Budget to pay for the government’s spending commitments given the gaps in UK public finances.

“The findings again highlight business owners’ interwoven professional and personal lives and finances, and the complexity and unpredictability this brings. The need for flexibility – and advice and support – to navigate this challenge has rarely been greater. It will be essential if UK businesses are to be ready for the next opportunity when it comes along.”

What are the factors that have driven the decision to bring your exit strategy forward? (Select all that apply)

The research was conducted by Censuswide, among a sample of 500 Business Owners (aged 18+) in the UK at companies with a turnover of £5m+. The data was collected between 04.04.2025-06.05.2025. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.